CrossWork Midas Fund

A Pre-IPO Portfolio Of Over 25 Exceptional, Late-Stage, AI, Enterprise Software, Life Sciences, and Other Companies.

PitchBook published a list of the 10 most likely AI companies to go public in 2024. We had already invested in 5 of them: Stripe, Anthropic, Cerebras, SingleStore, and other giants.

For accredited investors only. Nothing herein is financial advice. Private companies are risky. See disclosures below and in materials provided to you.

Prefer to review materials first? Evaluate key strategic and financial benefits here:

Review Materials Now

Ready To Invest Before The Fund Closes? Invest Here

Powerful discount investment strategy in pre-IPO companies:

We invest in very late stage pre-IPO companies valued at over $1 billion with revenues generally over $100 million and first-class existing institutional investors. We aim to invest at a substantial discount to the last institutional round. Average discount as of Jan 2024 of our recent fund is almost 50% to the last institutional round.

Current portfolio company investments and holdings:

30+ portfolio companies including among others: Stripe (reached $95 billion+ valuation), Cityblock Health (reached $6 billion+ valuation), Rappi (reached $5 billion+ valuation), Salsify (reached $2 billion+ valuation), Tealium (reached $1 billion+ valuation), BigID (reached $1 billion+ valuation), Tradeshift (reached $1 billion+ valuation), Podium (reached $3 billion+ valuation), Aviatrix (reached $2 billion+ valuation), ThoughtSpot (reached $4 billion+ valuation), Cerebras (reached $4 billion+ valuation) and Outreach (reached $4 billion+ valuation).

Includes over 10 late stage Artificial Intelligence or AI related companies with annual revenues averaging over $100 million.

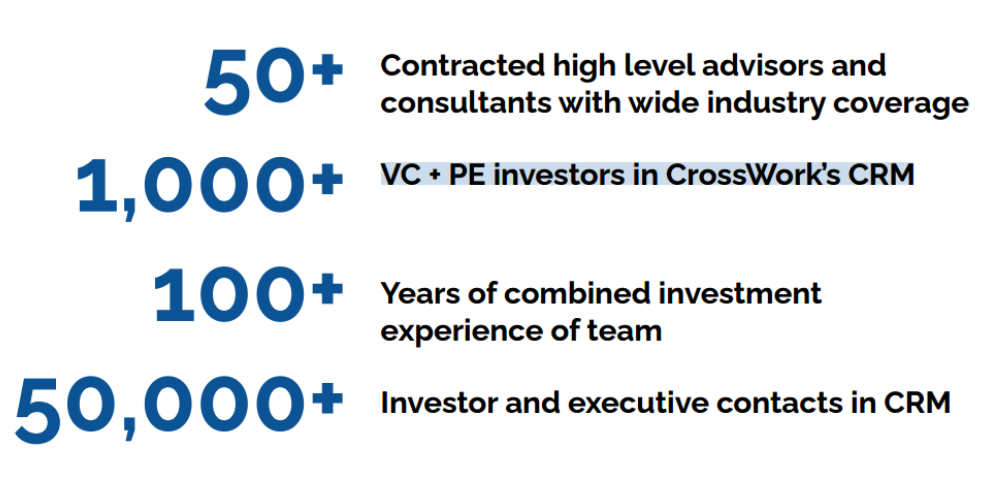

Advisory board competitive advantage:

70+ members provide critical/proprietary diligence insights, guidance, deal access, advantage and counsel on investment decisions. E.g. Ex Spirit Airlines CEO, Ex Peabody Energy COO, Ex Weight Watchers CFO, Ex Yahoo CFO, co-developer Lipitor (a top selling drug of all time), Harvard professor, heads of VC funds, founder WordPress, Shark Tank judge, artificial intelligence industry leaders (from Stripe, DataRobot, others), ex Goldman Sachs bankers etc.

Other investors in our portfolio companies:

Softbank, Elon Musk, Goldman Sachs, Morgan Stanley, Fidelity, Kleiner Perkins, Koch Industries, Salesforce.com, Sequoia, Tiger, Google Ventures, Andreessen Horowitz, Softbank, Bain Capital, American Express, HSBC, Benchmark, and others.

Liquidity anticipated horizon:

Anticipated capital returns commence within an estimate of one to three years of investment.

Core industries of interest:

AI, B2B SaaS, Semiconductors, software, life sciences, alternative energy, industrial, and consumer. Targets: Revenues (recent year) >$100 million, Revenue recurrence > 80%, Growth > 30%, Gross margins > 75%, Profitability: Current or visible.

Sector return news:

Secondaries investments have historically achieved similar IRR with lower volatility than primary private equity transactions (Goldman Sachs 12/22).

To learn more about CrossWork's signature pre-IPO Midas Fund, review detailed fund information.

SOME RECENT CROSSWORK MIDAS FUND INVESTMENTS

TESTIMONIALS

We are highly impressed by CrossWork, its track record of billion dollar exits, its lengthy experience with pre-IPO companies (going as far back as Facebook, Twitter and Cvent) and its ability to attract substantial pre-IPO companies

In addition to completing an investment in Cvent, Steven (CrossWork Partner), helped us complete our round and provided us with significant strategic guidance

They have a large deal network and are strong at sourcing deals and completing investments

SCHEDULE AN INTRODUCTORY MEETING

*This page is intended for accredited investors only. This is not an offering document and does not constitute and offer for the sale or purchase of securities on any jurisdiction. Past results are no guarantee of future results. No financial advice is provided herein. Investments in private companies are illiquid and risky with the risk of capital loss. The information provided herein is sourced from third parties and is subject to error. You should only make decisions based on your own due diligence, not the information provided herein. You should consult with your financial advisors and similar professionals when evaluating potential opportunities such as those described herein. Please review risk and other disclosures on all materials that you are provided with. Disclosures cover a wide range of important matters including investment structures, operational matters and more.

CrossWork © Copyright 2024